The international schools market is expanding faster than ever. Once concentrated in a few established hubs, demand is now spreading to emerging regions where new opportunities are taking shape.

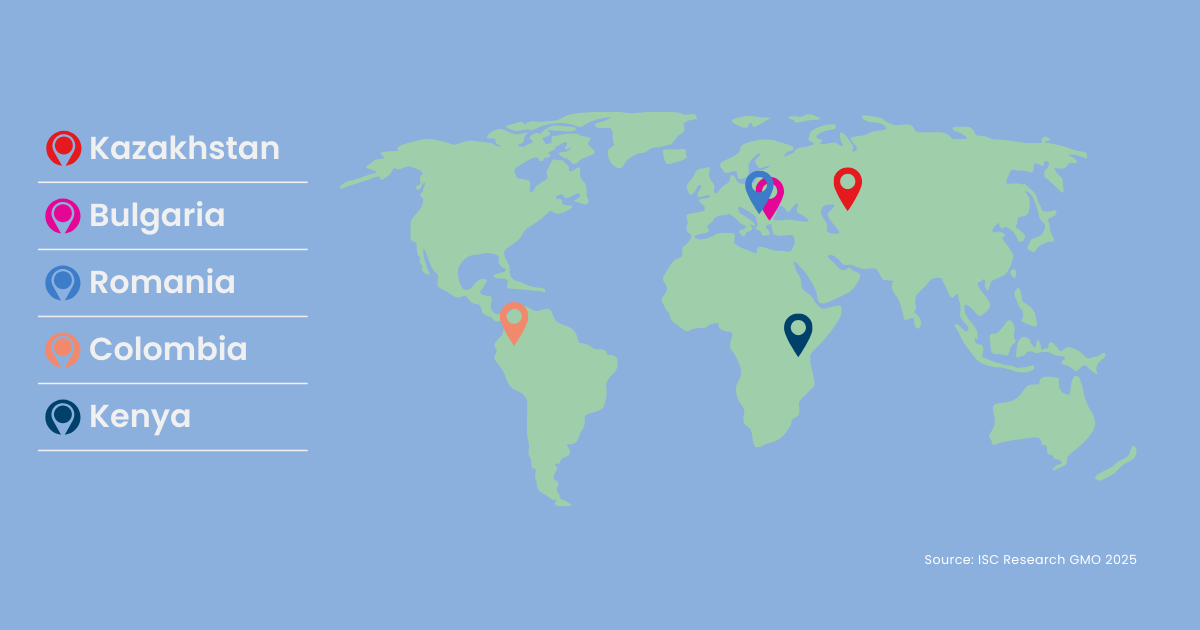

In 2025, global fee income for international schools reached $69.4 billion USD, underscoring the sector’s resilience and long-term growth potential. According to ISC Research’s Global Market Overview 2025, the most promising prospects are increasingly found in new K–12 destinations across Central Asia, Eastern Europe, Latin America, and Africa.

These emerging countries highlight how global education trends are combining with local economic, demographic, and policy conditions to create exciting new opportunities for international school growth. Read on to discover where demand is rising and what this could mean for schools, operators, and investors looking to expand.

Discover full insights, data, and trends in the Global Market Overview 2025 to guide your strategic decisions.

Kazakhstan: Central Asia’s rising international school hub

Kazakhstan is quickly becoming a key destination for international schools in Central Asia. Population growth, strong local demand, and government investment are driving the expansion of high-quality education options.

Regulations allow foreign ownership and give schools offering IB or Cambridge programmes curricular autonomy, creating an attractive environment for international operators. Cities like Almaty and Astana are established hubs, while Shymkent is emerging thanks to new industrial investment.

For schools and suppliers, opportunities include opening new campuses, offering globally recognised curricula, or partnering with local institutions. With supportive policies and growing demand, Kazakhstan represents a market with significant early-stage potential.

Bulgaria: New opportunities in an integrated Europe

Bulgaria’s international school sector is gaining momentum in Europe, underpinned by clear regulations and a close alignment with EU standards that offer stability for long-term investors.

Demand is rising from two directions. Bulgarian families are turning to international schools for globally recognised curricula, while expatriate communities connected to multinational firms are also driving enrolment growth. Institutions including Bulgarian Progressive Schools are already expanding in Sofia, Plovdiv, and Burgas.

Opportunities are widening as Bulgaria strengthens its EU position. Schengen accession in January 2025 and the planned adoption of the Euro by 2026 are expected to boost mobility and trade, confidently positioning the market for expansion.

Romania: Modernisation as a catalyst for growth

Romania is a promising market for international schools, supported by regulatory stability and modernisation.

Recent accession to the Schengen Area has eased mobility for expatriates and educators, while closer alignment with NATO and the EU has reinforced investor confidence. Meanwhile, local demand is shifting decisively. Families dissatisfied with public options are choosing international schools for their quality and student support.

For schools and suppliers, opportunities include new campus developments, partnerships with local institutions, and the introduction of internationally recognised programmes. With large-scale projects such as the Transylvanian Motorway improving connectivity, Romania is positioning itself as a sustainable market for growth.

Colombia: Bilingual education as a driver of global opportunity

In Colombia, strong parental aspirations continue to drive demand for international schools. Families in Bogotá, Cali, and Bucaramanga view bilingual education as an essential pathway to global universities and international careers.

The regulatory environment remains complex, with tuition caps and debates around new legislation adding uncertainty. However, schools that align with government goals around bilingualism, inclusivity, and intercultural learning are well positioned for growth.

Future opportunities await investors able to navigate regulation, and operators and suppliers seeking to serve an expanding middle class and build capacity in key cities. With GDP projected to grow 2.4% in 2025, Colombia offers a resilient and strategically important market in Latin America.

Kenya: From curriculum shifts to market opportunity

Kenya is one of Africa’s most dynamic international school markets, driven by urbanisation and a rising middle class. The recent shift to a competency-based curriculum has exposed gaps in public schools, leading families to view international schools as more consistent and rigorous alternatives.

Nairobi remains the central hub, with multinational corporations and organisations like the UN and Nestlé sustaining steady demand. Schools are investing in new facilities to accommodate enrolments and modernise learning environments.

With 117 international schools operating, opportunities are expanding for new campuses, boarding facilities, and curriculum offerings to meet enrolments. Growing demand in Nairobi, Mombasa, and Eldoret underscores Kenya’s potential as a long-term market for international education.

Why these markets matter

Together, these five countries illustrate the next frontier of international education. Each is shaped by different political, economic, and cultural factors, yet all share a common theme: rising demand for globally recognised education as families look to secure the best possible future for their children.

For international school leaders, operators, and suppliers, these markets reveal where education is being prioritised, how governments are creating conditions for investment, and where shifting family aspirations are driving demand.

To gain actionable insights and our latest data on these emerging opportunities, ISC Research’s Global Market Overview 2025 provides the guidance needed to make informed strategic decisions.